Report Overview

The global e-cigarette and vape market size was valued at USD 18.13 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 30.0% from 2022 to 2030. The rising awareness about e-cigarettes being safer than traditional cigarettes, especially among the younger population, is anticipated to further drive the market growth due to various studies carried out by medical institutions and associations. The array of customization features such as temperature control and nicotine concentrations offered by the vendors is expected to aid the product demand. Moreover, developing e-cigarette technologies such as pod systems and squonk mods have increased popularity in recent years and user adoption.

To learn more about this report, request a free sample copy

Amid the COVID-19 pandemic, e-cigarette and vape vendors have adopted several COVID-19 based marketing strategies to increase product sales. The growing emphasis on adopting safer alternatives to smoking is anticipated to drive the adoption of e-cigarettes and vape devices over the forecast period. As the supplies of e-cigarette and vape devices became scarce in physical stores, the vendors started offering their products through online platforms and offered hand sanitizers and face masks as gifts to purchase vaping products.

The e-cigarette and vape market has evolved considerably since 2017, and the devices have become more efficient in battery life and the number of flavors available in the market. Additionally, various flavors such as menthol, tobacco, fruits and nuts, and chocolate are available in the market, attracting many customers. These flavors emit aromas when used in an e-cigarette or a vape device. Additionally, the increasing cost-effectiveness of these devices has further enhanced customer adoption and is expected to drive market growth over the forecast period.

The e-cigarette industry has witnessed a high rise in atomizers and e-liquids owing to high demand in regions such as North America and Europe. Countries such as the U.K. have legalized the consumption of e-cigarettes, which has stimulated market growth significantly. Furthermore, vape shops have been established where customers can personally visit and test the devices and e-liquid flavors before purchase. In England, tank e-cigarettes have remained the most popular device type; however, pod e-cigarettes have become the most popular, owing to the surge in JUUL (Juul Labs, Inc. is an American electronic cigarette company) use.

Market participants in the e-cigarette industry are prominent players who own a significant market share. The companies have primarily invested in e-cigarettes as it is expected to be an effective alternative solution for tobacco consumption. However, the industry has a presence of various small players that offer efficient vaping devices and e-liquids, thereby acquiring a large customer base. Small companies usually outsource the manufacturing of e-cigarettes to Asian countries such as China to competitively price their products.

However, the regulations levied by local authorities across various countries such as the U.S. and India on the sale of vaping products and e-liquids have restrained the market growth. Furthermore, stringent trading laws have made it difficult for retail consumers to import vaping devices for personal consumption. However, it is expected that regulations on traditional cigarettes are expected to accept e-cigarettes as a healthy alternative to tobacco consumption, thereby regulating the technology for safe distribution and usage. Also, the vaping industry has formed various associations to counter the policies against vaping products and regularize the industry for supervision, eventually driving the growth of the market for e-cigarettes and vaping.

Product Insights

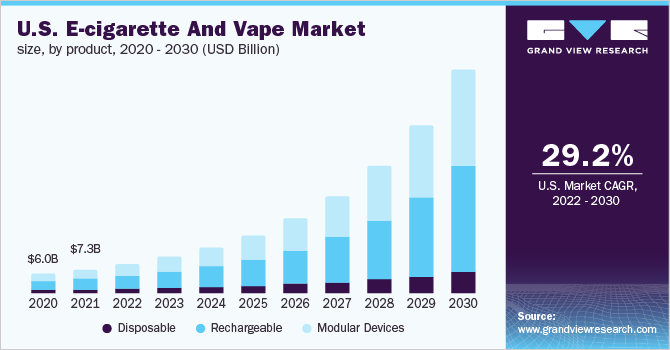

The rechargeable segment accounted for the highest market share of over 40% in 2021. The adoption of rechargeable devices is expected to increase as they tend to be affordable and eliminate the need to re-purchase supplies, such as cartridges. Also, customers making DIY e-liquid need not purchase pre-filled cartridges. Seasoned vapers particularly find it economical to purchase rechargeable e-cigarettes. Also, rechargeable e-cigarettes produce less smoke and can be charged in the USB port, thus are becoming popular among youth in many key countries.

The modular devices segment is anticipated to register a significant CAGR over the forecast period. The key demand factor is that these devices offer high-level customization options to combine different features and parts. These parts and components alter the flavor and the amount of vapor generated from the device, depending on personal requirements. Various vaping events, such as vape conventions and competitions, are organized regularly in North America, thereby stimulating the demand for modular devices in the region.

Report Coverage & Deliverables

- Competitive benchmarking

- Historical data & forecasts

- Company revenue shares

- Regional opportunities

- Latest trends & dynamics

Distribution Channel Insights

The retail store segment accounted for the highest market share of over 84% in 2021. Earlier, e-cigarettes were sold in retail outlets such as vape shops and gas stations. These shops assisted customers in selecting from a wide range of devices and e-liquids. Furthermore, vape shops allowing customers to try out and test these devices before making a purchase decision is expected to drive the retail store segment growth over the forecast period.

To learn more about this report, request a free sample copy

The online segment is anticipated to register a significant CAGR over the forecast period. The benefits of online marketplaces in terms of competitive pricing, convenience, and access to a wider variety of products encourage people to purchase e-cigarettes and vape online. The Asia Pacific region has witnessed several online shopping websites selling e-cigarettes coming up. The region has also been witnessing a rising demand for e-cigarette products, encouraging sellers to sell e-cigarettes online.

Regional Insights

North America dominated the global market with a share of over 40% in 2021. The social media presence of major industry players is widely used for selling e-cigarettes and vaping products. The young population has largely adopted vaping devices as a safer alternative to tobacco, which is expected to boost the adoption of the product. However, the current ban on some e-cigarette flavors, including fruit and mint flavors, in the United States to limit underage vaping in the country is expected to stifle market growth in the region to some extent.

Given that most e-cigarettes are imported from other countries, such as China. Furthermore, customers find it more convenient to purchase e-cigarettes in bulk via online platforms, which is expected to drive Asia Pacific regional market growth. Over the forecast period, the European regional market is expected to grow significantly. The region’s health bodies approve e-cigarettes and vaping from vendors such as British American Tobacco Plc’s Vype and Imperial Brands Plc’s Blu as a better alternative to tobacco smoking, which is expected to drive market growth in Europe.

Key Companies & Market Share Insights

To effectively maintain communication with the consumers and be in regular exchange with their dispensary partners, e-cigarette and vape vendors worldwide are expected to engage in aggressive social media marketing techniques. This is necessary to keep consumers focused and boost future growth strategies. In the post-COVID-19 era, personal vaporizers allow users to avoid sharing e-cigarette and vape equipment, which is critical.

The industry is characterized by few entry barriers for new players as new players can establish their business with minimal investments. Large companies are pursuing inorganic growth strategies such as partnerships, acquisitions, collaborations, and strategic agreements to increase their customer base and geographical reach.

For instance, in September 2020, Japan Tobacco Inc. announced its partnership with Sauber Engineering AG, a prototype and technology developer. Through this partnership, the companies would continue to collaborate on developing engineering projects to increase the performance of Japan Tobacco Inc. products. For instance, in March 2019, Japan Tobacco Inc. announced the launch of new flavors of tobacco capsules. The two flavors include a mixed pineapple, peach, and menthol. Some of the prominent players operating in the global e-cigarette and vape market are:

- Altria Group, Inc.

- British American Tobacco

- Imperial Brands

- International Vapor Group

- Japan Tobacco Inc.

- NicQuid

- JUUL Labs, Inc.

- Philip Morris International Inc.

- R.J. Reynolds Vapor Company

- Shenzhen IVPS Technology Co., Ltd.

- Shenzhen KangerTech Technology Co., Ltd.

E-cigarette And Vape Market Report Scope

| Report Attribute | Details |

| Market size value in 2022 | USD 22.46 billion |

| Revenue forecast in 2030 | USD 182.84 billion |

| Growth rate | CAGR of 30.0% from 2022 to 2030 |

| Base year for estimation | 2021 |

| Historical data | 2017 – 2020 |

| Forecast period | 2022 – 2030 |

| Quantitative units | Revenue in USD million and CAGR from 2022 to 2030 |

| Report coverage | Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Product, distribution channel, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; U.K.; Germany; China; South Korea; Japan; Brazil |

| Key companies profiled | Altria Group, Inc.; British American Tobacco; Imperial Brands; International Vapor Group; Japan Tobacco Inc.; NicQuid; JUUL Labs, Inc.; Philip Morris International Inc.; R.J. Reynolds Vapor Company; Shenzhen IVPS Technology Co., Ltd.; Shenzhen Kanger Tech Technology Co., Ltd. |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global e-cigarette and vape market report based on product, distribution channel, and region:

- Product Outlook (Volume, Million Units; Revenue, USD Million, 2017 – 2030)

- Disposable

- Rechargeable

- Modular Devices

- Distribution Channel Outlook (Revenue, USD Million, 2017 – 2030)

- Online

- Retail

- Convenience Store

- Drug Store

- Newsstand

- Tobacconist Store

- Specialty E-cigarette Store

- Regional Outlook (Volume, Million Units; Revenue, USD Million, 2017 – 2030)

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- Asia Pacific

- China

- South Korea

- Japan

- Latin America

- Brazil

- MEA

- North America